Will TANQR solve the fees problem?

Yes, I can pay any merchant from any provider, but at what cost in fees?

The Central Bank Of Tanzania launched TANQR to Boost up the use of e-payments under the Retail Payment ecosystem, hence enabling more Tanzanians to make electronic payments and deepening financial inclusion.

One of the primary roles of TANQR is interoperability. For non-fintech or tech folks, interoperability means the ability of different systems, apps, or payment platforms to work together seamlessly. For TANQR, interoperability means that customers can use any bank or mobile money account to make payments with the same QR code(which are also presented in Till Numbers) , no matter which provider(Bank, Mobile Money or Payment Service Provider) the merchant uses.

Without TANQR;

Imagine you go to a shop to buy groceries. The shopkeeper only accepts payments through M-pesa Till Number, but you have a Tigo Pesa account. Without TANQR, you wouldn’t be able to pay because the two provider’s merchant payments systems don’t work together.You would either have to carry cash or open a new account with M-pesa, which is inconvenient.

With TANQR;

It doesn’t matter whether the shop uses M-pesa Merchant account, Tigo Pesa merchant account or CRDB Bank merchant account, you can simply scan the same QR code or write Till Number and pay from your wallet, no matter which provider you use. TANQR connects all the systems to make payments easier for everyone.

When TANQR works one of the major expectations might be;

Consumers will have the freedom to pay without worrying about the merchant’s payment options, knowing that their single wallet can be used to pay any provider.

While

On the other hand, we expect that merchants might eventually use a single or fewer wallets to collect payments from consumers using different providers, but this isn’t fully happening yet.

A couple of times (for example, last night), I was paying for something, and the merchant had at least three different QR codes or till numbers from different providers. When I asked them, “Why do you have three of them when one could let you collect payments from all providers?” their answer was:

“Yes, my customers can pay me from any channel (this means interoperability works), but the fees consumers are charged to pay merchants depend on which provider they use. If the provider is different from theirs, they are charged more. So, I have all these options so that my customers can choose and pay using the same provider they use and be charged less. I do this for my customers.”

This was the best insight to hear, Since then, I have been researching (and still am) to confirm this insight. As part of my research, I tried to pay into one merchant account by using my two mobile money accounts from different providers, and I realized that the fees also vary depending on which provider you use to make the payment.

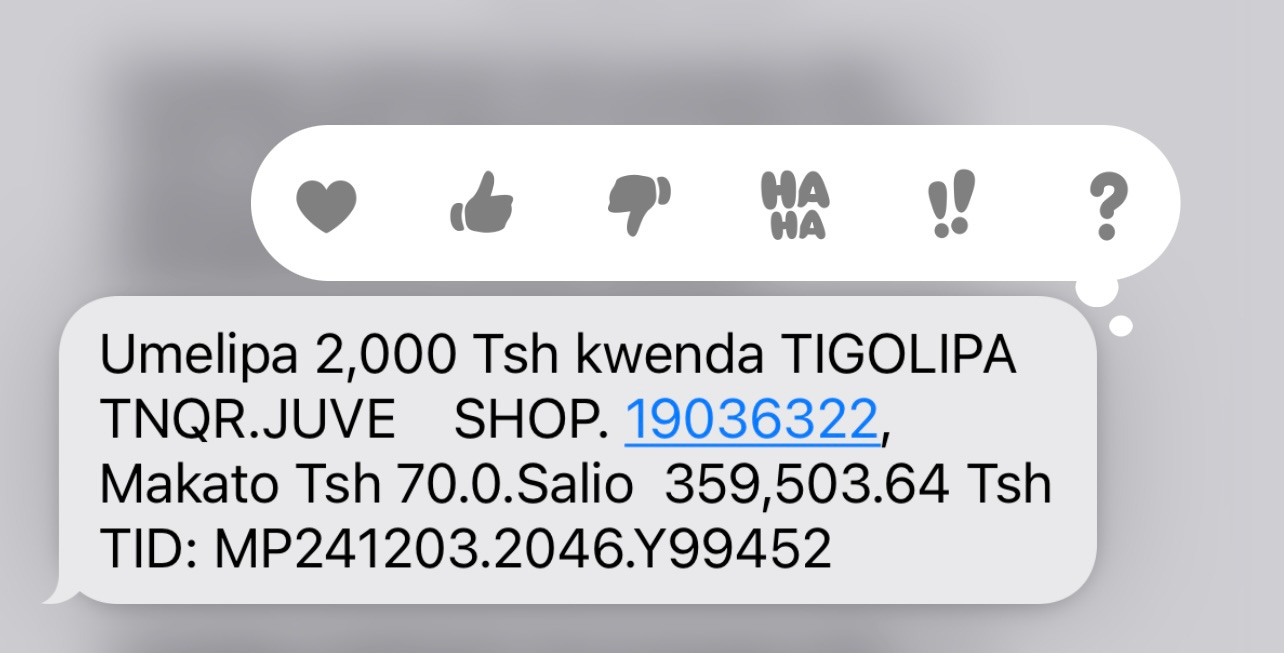

I was paying 2,000 TZS to a Tigo Pesa merchant from my Airtel Money account which charged me 70 TZS (3.5% of the transaction) in fees,

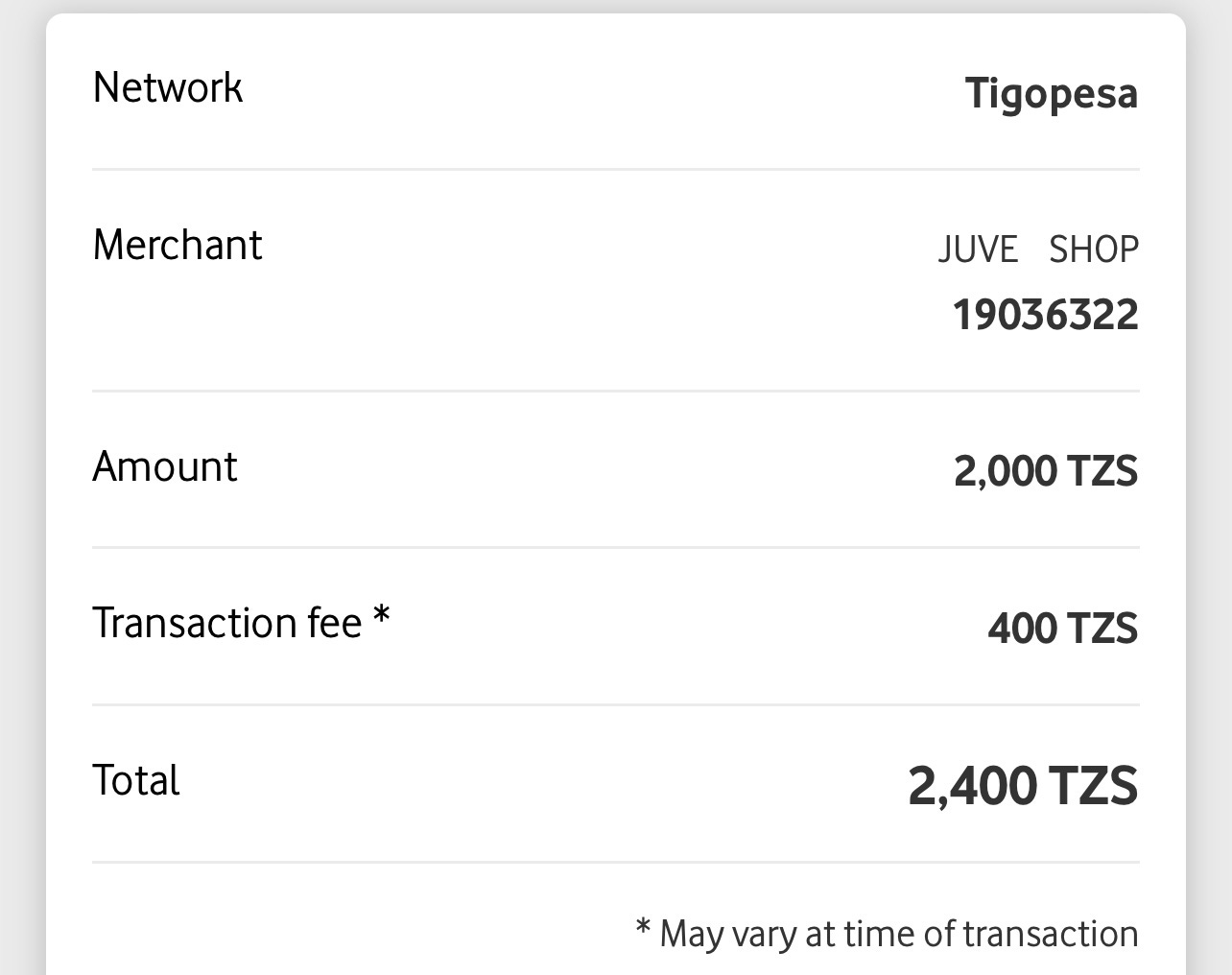

M-Pesa charged me 400 TZS (20% of the transaction) in fees to pay the same merchant, the same 2,000 TZS.

Will TANQR help solve the fees issue?

While we have interoperability, the varying fees and the fact that the merchant still has to use up to four different QR codes or till numbers from different providers to help their customers pay less, somehow questions the relevance of this interoperability. Yes, I can pay any merchant, but at what cost in fees?

Will TANQR help solve the fees issue? I would really appreciate your thoughts on this.

Thanks for reading. You can personally contact me via Twitter , LinkedIn or Email; founder@swahilies.com.