Why C2B payments market is hard for aggregators in Tanzania

Insights on C2B payments market in Tanzania

In most parts of the world, business owners are responsible for paying the payment service fees to the provider. For example, if you run a business and receive a $100 payment from a customer through Stripe, you (the business owner) might be charged around 3%, which would be $3, by Stripe.

For payment companies, this is the best business model because their customer is the business owner. Once business owners receive payments from customers, the payment companies can take their cut and settle the rest with them. Technically, consumers make payments from and through various channels like mobile money, cards, or other platforms. It is not easy for payment companies to access and charge consumers from all these payment channels. The most assured scenario is that, regardless of the platform consumers use to pay, the money will reach the business owner through the payment company’s platform, allowing them to get their cut.

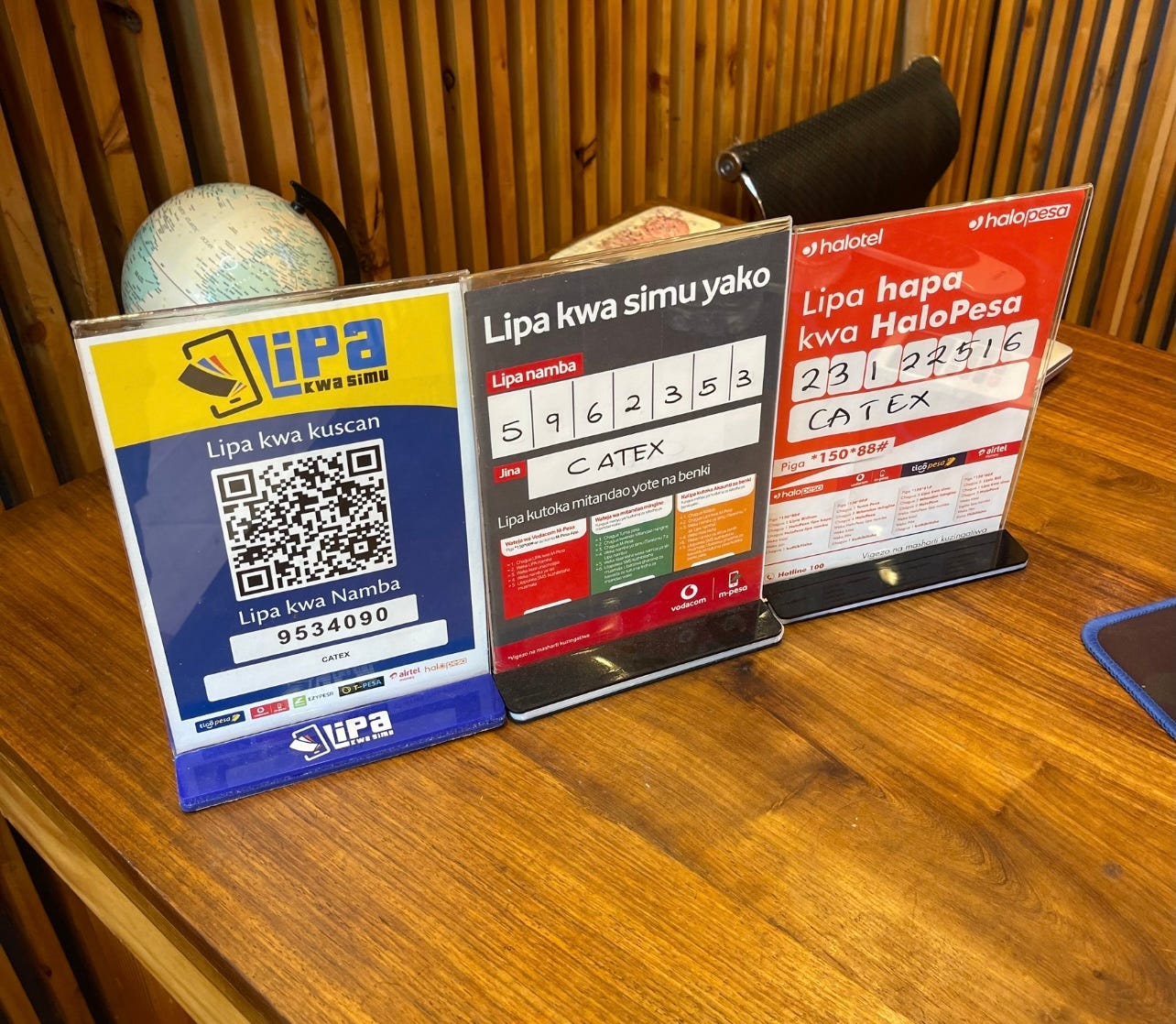

In Tanzania, it is different; mobile money companies charge consumers when they pay businesses.

The most assured way to charge consumers when making payments to business owners or anywhere else is if they pay through your platform. In Tanzania, where ~ 72% of the 60 million population use mobile money, mobile money platforms have that assurance. Therefore, they charge consumers while businesses are charged zero fees, which encourages them to accept digital payments.

Why do Mobile money companies charge consumers?

I asked this question to an employee of a mobile money company, and he answered: “Businesses would opt to continue trading on cash economy over digitization the moment you tell them to cover those costs on behalf of their customers”.

How much do mobile money companies charge consumers to pay businesses or merchants?

It depends, as it is not charged as a percentage but varies with transaction size. However, it can cost up to 19% for consumers to pay 5,000 TZS to merchants who use a different mobile money provider. Given this, it is clear that most business owners would not accept these fees if they were pushed onto them; they would opt for cash instead. Recently, there has been a lot of discussion about high payment fees in Tanzania.

How does this challenge payment companies in the market?

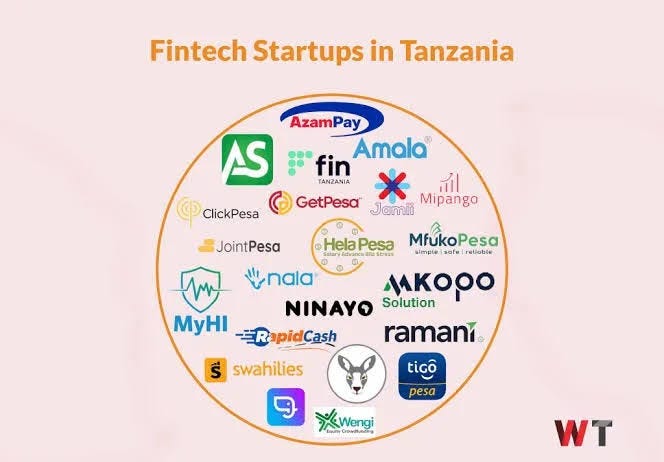

Most African business owners are very sensitive to fees. As long as mobile money companies charge them zero transaction fees and settle instantly, very few will accept being charged any fees by payment aggregators or other companies for accepting the same digital payments. For other payment companies that have operated in other markets with a business model based on charging businesses, they must rethink their models and strategies when expanding to Tanzania.

Can’t other payment companies charge consumers?

For every transaction made by consumers using mobile money, the mobile money companies already charge a fee. If other payment companies choose to charge consumers as well, it means they add an additional fee on top of the existing one. As a result, consumers will be charged twice; once by the mobile money company and once by the other payment company. This becomes unrealistic and cant scale.

How do other mobile money companies and banks compete with that?

Most payment aggregators or companies (non-mobile money and non-banks) have a primary role of helping business owners get paid and sending those payments to the business owner’s bank account or mobile money account. The only place they can make money is when the consumer to business transaction happens, but mobile money and banks are looking way further.

Other mobile money companies are fine with onboarding merchants, charging them zero fees on C2B payments, and not making money from consumers who are not using their platforms (different mobile money), as they believe that once the business owner accepts the payment, they have the option to pay bills or make other expenditures using the same mobile money account, enabling them to generate revenue. This is similar to what banks do for their merchants who are being paid by mobile money customers.

As a C2B payment company where you don’t have access to charge consumers, business owners don’t want to speak to you whenever you mention charging them and your primary role is to ensure your merchants get paid on your platform and receive their money in any of their bank accounts. Now you have to think more on how sustainable your business can become.

If mobile money companies start charging business owners, we should expect to see the rise of more C2B payments companies and even more competition in the C2B market beyond just mobile money companies themselves. If this doesn’t change, I think there will be more partnerships between banks and C2B payment service providers to explore how they can extend their business models to make money from merchants beyond just the C2B transaction. Perhaps this is the reason we should expect to see some payment companies become banks or mobile money in Tanzania market.

Thanks for reading! You can personally contact me via Twitter or LinkedIn or Email me at founder@swahilies.com for any feedbacks.