Why Banks Love Mobile Money Partnerships

Discusing the reasons and benefits behind banks forming partnerships with mobile money services

Earlier, it was easy to look at mobile money and banks and conclude that they should be competing, but as the days go by and financial services evolve in Africa, mobile money and banks are becoming more like partners to deliver financial services to millions of Africans easily, faster, and conveniently. An example of a mobile money and bank partnership is Safaricom(M-pesa) and the Commercial Bank of Africa (CBA) collaborating to launch M-Shwari in 2012. This partnership provides access to interest-bearing savings accounts and the ability to take out small loans for Kenya M-Pesa users. In 2022, ~ $5.7 billion was deposited in M-Shwari.

Most mobile money and bank partnerships have focused on lending. Just Last month, Vodacom Tanzania (M-Pesa) and CRDB Bank collaborated to launch Buy Now Pay Later smartphone loans. Why banks love mobile money partnerships?

Large Customer base

As of 2023, 72% of the 60 million Tanzanians use mobile money services, up from 60% in 2017, while 22% of the population uses commercial banks. Banks partner with mobile money to leverage the mobile money pool of customers to offer their financial services. Most Africans are using mobile money and not banks. It is easier and faster to convince Africans to use banking services on mobile money than on traditional banking platforms. By 2015, half of all M-Shwari customers (a financial product by a traditional bank accessed on M-Pesa) did not have any other bank account. Banks have the option to spend money, time, and other resources to acquire customers on their platforms or instead leverage mobile money to deliver their banking services faster to an already existing pool of mobile money customers.

Low Customer Acquisition Cost(CAC) and Know Your Customer(KYC) sharing

One of the key steps in providing any financial service is KYC (Know Your Customer). It is a careful process that involves time and other resources to ensure the company onboards the right customers and mitigates risks like fraud. When partnering with mobile money, banks use existing ‘know-your-customer’ (KYC) details that mobile money collects during customer registration of the SIM card and mobile money account. This helps banks spend fewer resources on acquiring customers and boosts the onboarding process for these customers. The cost of acquiring a customer from scratch is higher than the cost of selling services to customers on platforms they are already using.

Better Credit Scoring and Debts repayments

I’m not yet sure if there is someone or an organization with more data on the financial behaviors of Africans in Sub-Saharan Africa than Mobile Money. The most available data used for credit scoring Africans is bank-based, and in fact, fewer Africans are using banks. Mobile money is using more of its data endpoints from how people are transacting (sending money, receiving money, paying bills, airtime usage, and more) to develop a credit score that can be used by them and their bank partners to score customers who want to receive loans. Another very important aspect of lending, after credit scoring, is repayments, and mobile money has become better at that by building direct debit features that allow lenders to collect their repayments even faster at the right times.

Large customer base + better credit score engine + better repayments = a good lending business.

What does the future of mobile money and bank partnerships look like?

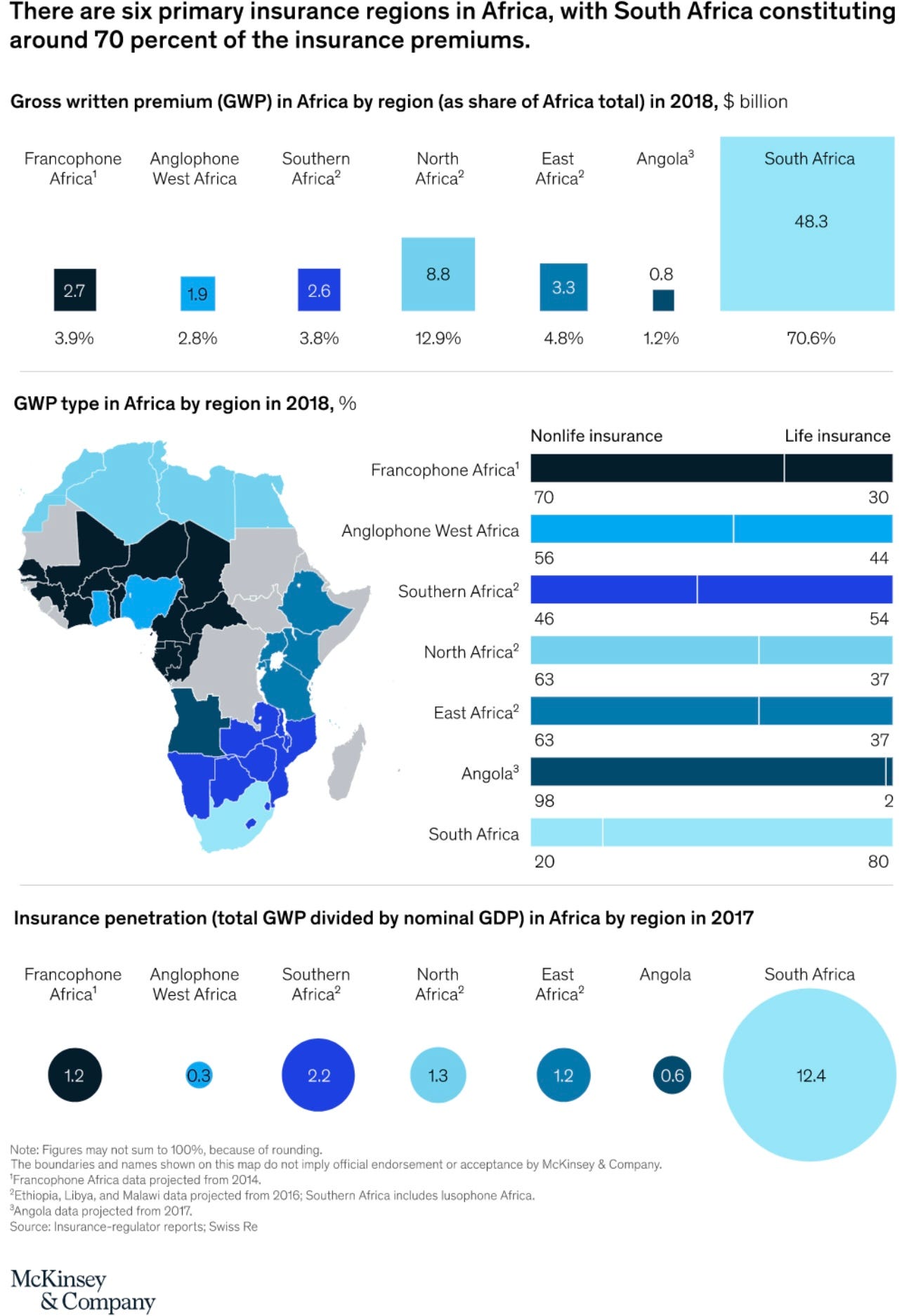

I expect to see mobile money companies evolving and connecting their customer base to more financial services like insurance, which is important but has had low penetration in Africa for a long time. Africa’s insurance market is worth $68 billion in terms of Gross Written Premium. Over 70% of this business is based in South Africa, with insurance penetration at 17%. Kenya has an insurance penetration of 2.7%, and Tanzania has a penetration of 0.7%. With mobile money companies data and a deep understanding of African behaviors, I expect more unlocking of financial services.

The day mobile money provides access to this data in a legal and ethical manner to other financial companies is when we will see most of the great innovations happen and boost financial inclusion on the continent

Source; McKinsey & Company

Where do you see mobile money partnerships with banks and fintechs heading in the future? Share your thoughts in the comments below.

You can personally contact me via Twitter , LinkedIn or Email; founder@swahilies.com