What Whatsapp Can Do For African Fintechs

Analysing Whatsapp use cases for Fintechs and businesses in Africa

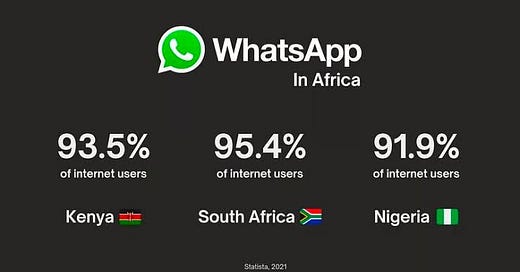

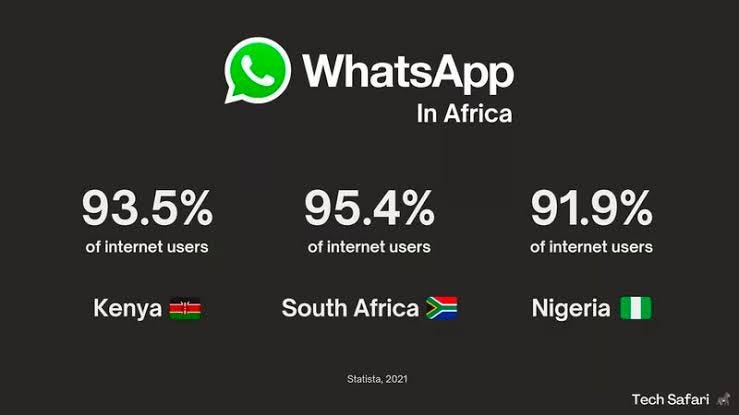

One of the most popular social media apps in Africa is WhatsApp.Approximately 95.4% of internet users in South Africa reported using WhatsApp every month. In Nigeria, 91.9% of internet users use WhatsApp; in Kenya, 93.5% and in Ghana, 89.9%. The more people use the internet, the more they use WhatsApp.

In the past few years different African companies started leveraging Whatsapp to offer different services.

Digital Banking

Absa Bank introduced a new wallet for WhatsApp banking in South Africa.

Centenary Bank launched WhatsApp banking in Uganda.

UBA Bank made history by introducing banking on WhatsApp and Facebook for the first time in Ghana.

Digital payments

Vendy pivoted to enable businesses to accept payments from your customers right on WhatsApp.

South Africa's Telkom introduced WhatsApp payments.

Stitch launched an AI-powered WhatsApp payment management bot.

Nedbank, Mastercard and Ukheshe launched a payment platform that lets small and microbusinesses conveniently receive secure in-chat payments from their customers via WhatsApp.

Digital Commerce

Catlog launched to help vendors create catalogs to sell products via WhatsApp.

Sukhiba pivoted to power Whatsapp conversational commerce in Africa.

Digital Lending

Yabx and Clickatell partnered to launch WhatsApp lending in Africa.

Mobile Money

Tigo Pesa launched a service to allow its Tanzania customers access mobile money services via Whatsapp.

Azam Pesa launched a service to allow its Tanzanian customers to self register and access Mobile Money services via Whatsapp.

HR

Jem launched to easily distribute payslips, IRP5 forms, timesheets, rosters and other information to employees using WhatsApp.

Why Whatsapp?

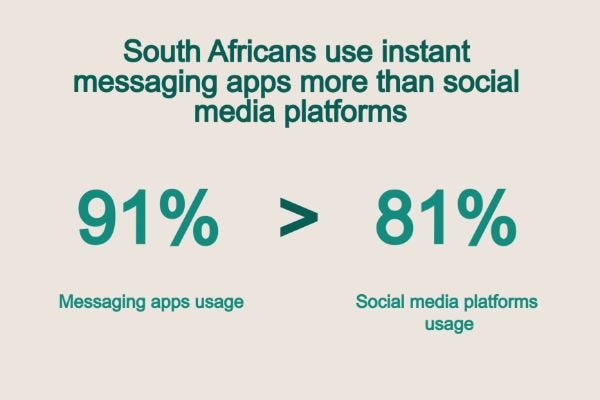

Most Africans use phones rather than Personal Computers (PCs) to access the internet, This is partly because mobile connections are much cheaper and do not require the infrastructure that is needed for traditional desktop PCs with fixed-line internet connections.- Statista reports.

What can Whatsapp do for African Fintechs and businesses?

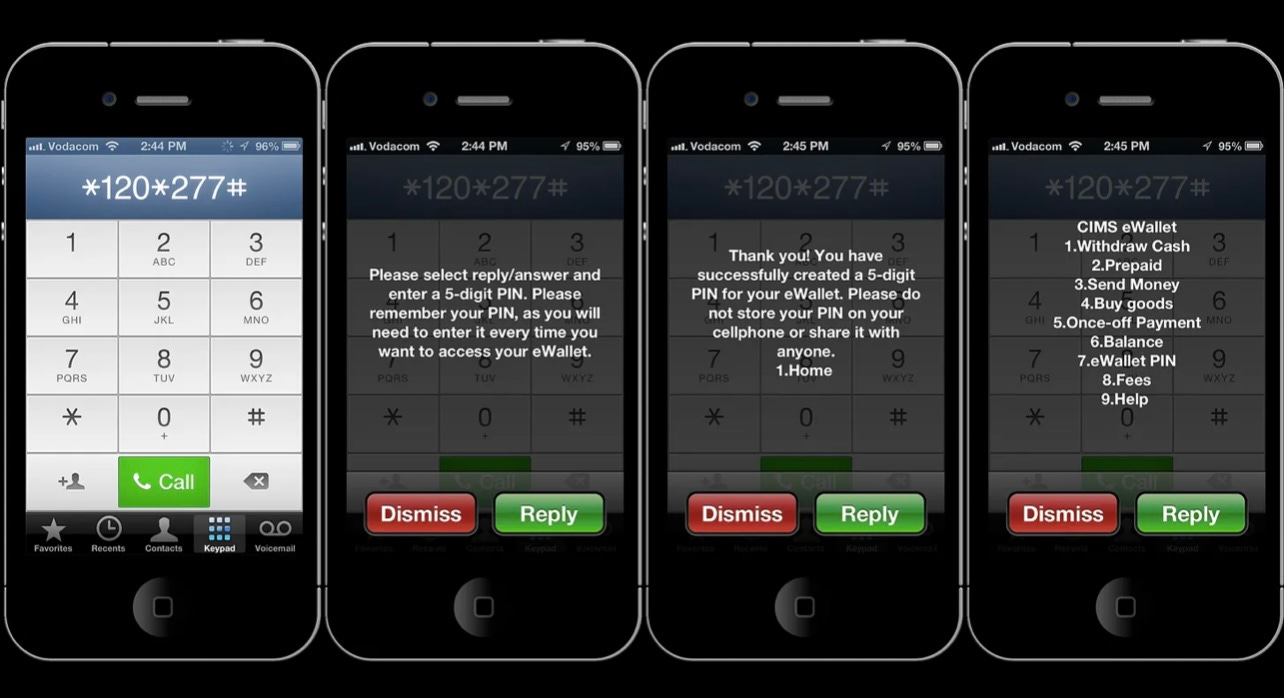

To answer this question well, think of what USSD did for mobile money companies, banks and other companies in distributing their services to Africans.

What is USSD(Unstructured Supplementary Service Data)? It is a telecommunication technology used for interactive communication. USSD Interaction, which is usually menu-based, involves sending text back and forth between a mobile phone and an application through the mobile networks. With the use of a unique USSD code like *123# customers can quickly and easily navigate the menu system on their mobile devices for a variety of reasons like data collection and for self-care services. User examples include checking bank account balance, paying utility bills, mobile polling, surveying, requesting certain information etc.

USSD sample

USSD Milestone

Everyday, more than a billion people use USSD to make transactions and access information. It powers 94% of all digital financial transactions across Africa.

The good thing about USSD

It can work offline (no internet data required), it works on both basic phones and smartphones, and of course, it is very simple to use.

The downside of USSD

It is not reliable (with over 50% failure rate), has a poor user interface and experience (can’t display media, often failing transactions without notifying users of the issues) and cannot be well customized nor personalized extensively to align with specific services.

Whatsapp for African Businesses

My hypothesis is that WhatsApp, which has the highest penetration rate in Africa and is very easy to access, with the expectation of more open APIs becoming available to increase optimization ,can be great for delivering various personalized services to Africans and replace USSD at scale.

In another view, i see WhatsApp in the same way as platforms like Google Play and the App Store, with even the potential to become a super app for African services. There are many opportunities for African businesses and companies to leverage WhatsApp for maximum reach. In a market like Africa, where people prefer not to keep many apps on their phones, offering mini services with personalized experiences on WhatsApp will be very effective.

African fintechs and businesses can use WhatsApp for customer onboarding and providing services such as banking, payments, commerce, lending, insurance, HR, ecommerce, booking and more. With more open APIs on the way, fintechs and other businesses can benefit from improved access to optimization, personalization, and other enhancements.

The other great news for businesses in Tanzania is that my company, Swahilies, has partnered with Neurotech to enable businesses of all sectors and sizes to sell products and deliver their services on Whatsapp and accept mobile money payments. This partnership allows businesses to build and launch their services in Whatsapp without coding nor any other tech skills . Kindly contact contact me if you are interested in this, i would love to work with you and your company on that .

Thanks for reading! You can personally contact me via Twitter or LinkedIn or Email me at founder@swahilies.com for any feedbacks.

How Swahilies and Sarufi uses WhatsApp, more deep clarification please