Of Africa’s nine unicorns, all except Andela are fintech companies. In 2024, fintech claimed nearly half of all start-up investments in Africa and welcomed two new unicorns: Moniepoint and TymeBank. I’m highly optimistic about what African fintech companies might achieve in 2025, and I’m willing to place my bets on the top 10 + 1 African fintechs to watch in 2025. If things go well, we might just see a unicorn emerge from this list(just saying).

1.M-Kopa

The ~ $400 million annual revenue company, with a 30,000-strong sales team, serves 5 million underbanked Africans by offering smartphones and other “productive assets” through flexible digital micropayments. Africa’s smartphone market grew by 24% in Q1 2024, driven by increasing affordability. Companies like M-Kopa are doing their best to make smartphones accessible to every African, which is why I’ll be keeping an eye on them in 2025.

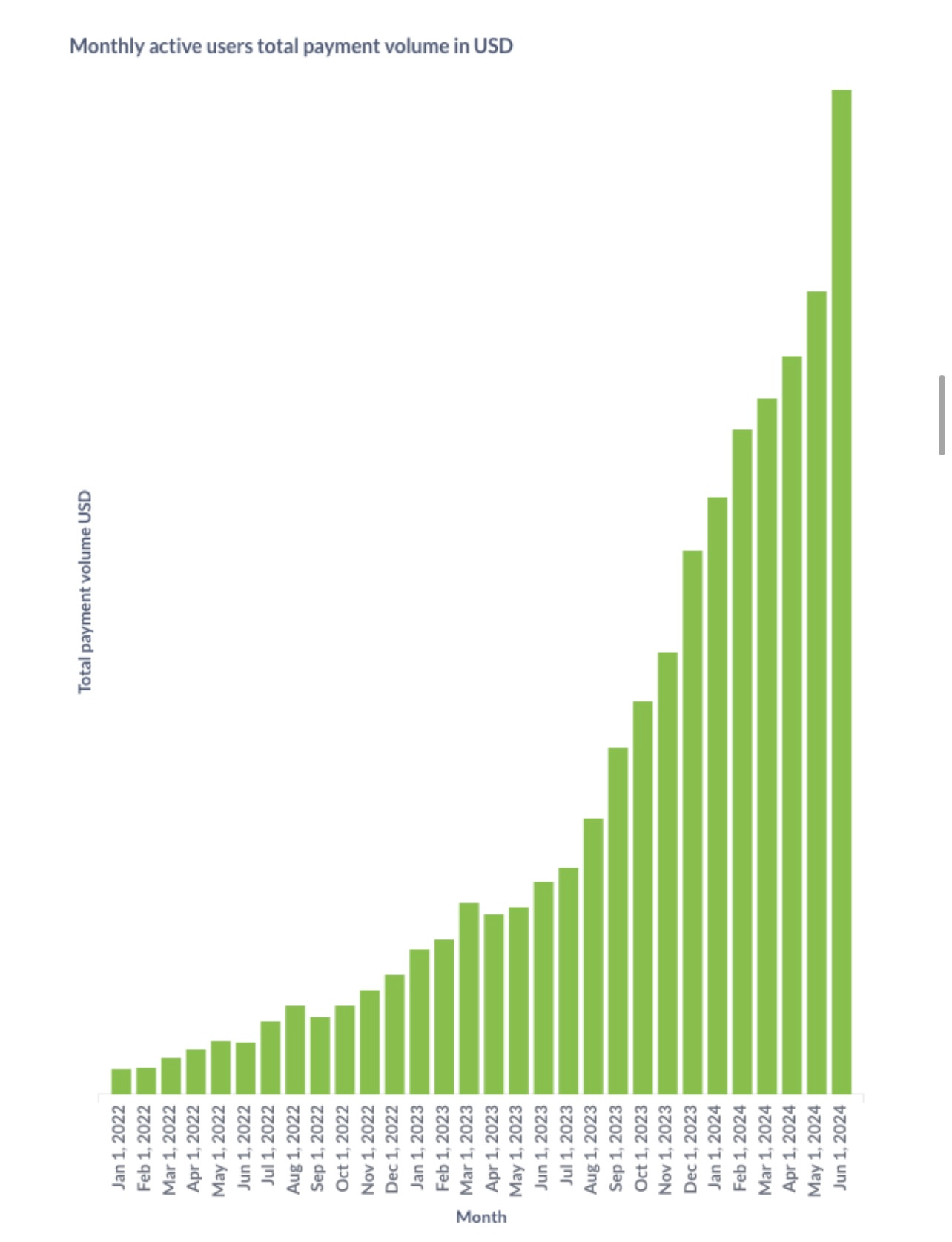

M-Kopa’s growth 2012 - 2024

2.Moove

The Uber-backed African mobility fintech, valued at $750 million with $115 million in annual revenue, offers vehicle financing to over 20,000 ride-hailing and delivery app drivers. One of the things that gets me to keep an eye on them in 2025 is how the company has been able to scale globally across at least four continents and strategically through partnerships with companies like Uber. Mobility will always be essential, and more Africans will need vehicles they cannot afford upfront to use on mobility apps, enabling them to earn money and repay Moove.

Moove’s funding rounds

3.Nala

It is one of the very few fintechs and startups growing rapidly and profitably. In remittance, Nala started with a consumer app that enables people in the E.U., U.K., and U.S. to send money across 249 banks and 26 mobile money services in 11 markets across Africa. Later in 2024, it launched Rafiki, its B2B payments platform, allowing remittance and other global companies to make reliable payouts to all banks and mobile money services in Africa. Remittance is an interesting market; Africa currently receives just under $100 billion in annual remittances, growing at a robust long-term CAGR of 10%, and everyone is entering it. What excites me about Nala is that from now on, anyone competing with Nala in Remittance is likely to be their B2B customer on Rafiki. Its founder always insists that they are more of a payments company than a remittance company.

Nala’s payments volume 2022 - 2024

4.LemFI

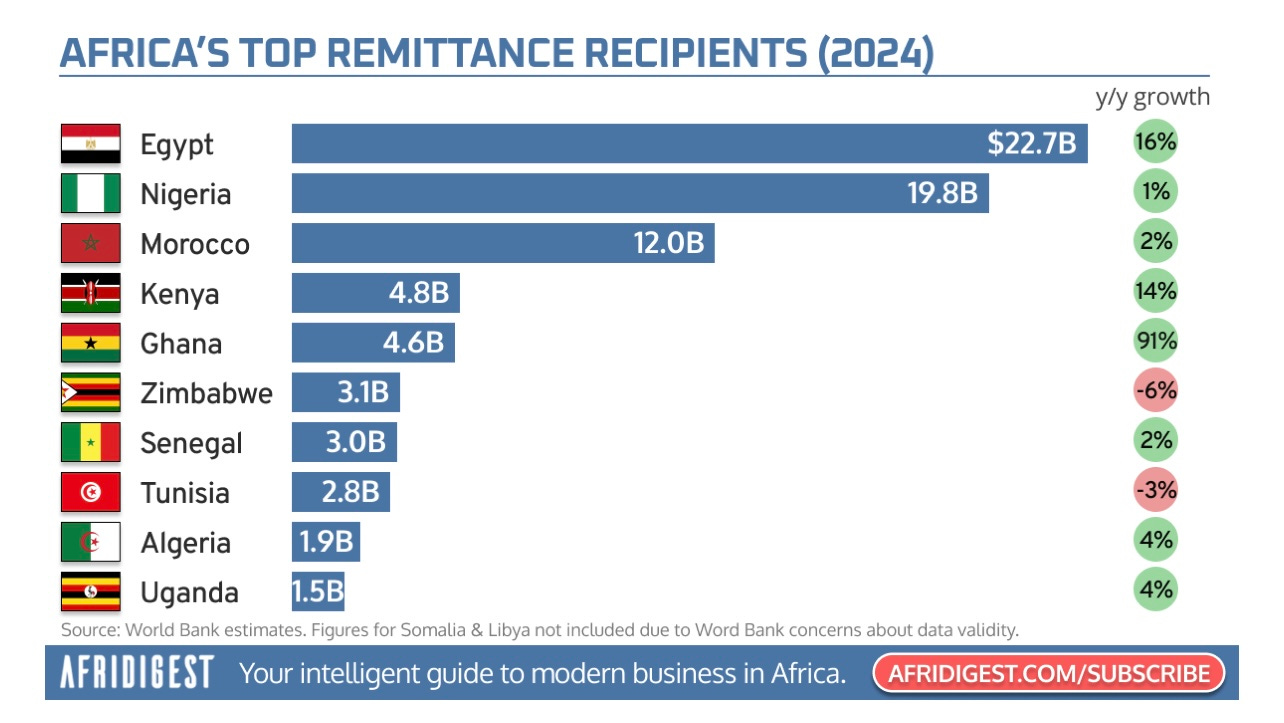

As i mentioned above, Remittance is an interesting market; Africa currently receives just under $100 billion in annual remittances, growing at a robust long-term CAGR of 10%. LemFI helps diaspora communities in North America and, more recently, Europe, send money to emerging markets across Africa, Asia, and Latin America. The company recorded over $2 billion in annual transaction volume in 2023 and now processes $1 billion in monthly payment volume. That is one of the things that excites me about LemFi; the numbers speak about the team’s execution capacity and what they do. No way I can close my eyes to them in 2025.

Africa’s Top Remittance Recipients(2024).

5.Yellow Card

Not just because Stripe acquired a stablecoin startup, Bridge, for $1.1 billion, but because I believe stablecoins will be massive in powering payments in Africa, making them cheaper and more reliable. I’m keeping an eye on Yellow Card because they have been in that space for over 8 years, have scaled to over 1 million African consumers, and now choose to focus more on B2B payments. They already work with 30,000 businesses and process $3 billion per year

6.Selcom

Tanzania’s biggest payments company, which has been around for 23 years and has over 100,000 merchants and agents in its agency banking network, acquired a bank in 2024 and is now piloting the first-ever Neo Bank, Selcom Pesa, in Tanzania. With their new banking service, I’m excited to keep an eye on them in 2025, i also real respect their resilience and ability to spot opportunities strategically where others can’t. Selcom has every integration needed to offer financial services in Tanzania. A few weeks ago, my friend sent me money from LemFi (which I also mentioned above) to my mobile money, and the first notification came from Selcom. That means LemFi’s Tanzania payouts are powered by Selcom, and that’s how you can start thinking about who they are.

7.Rise

The Nigerian fintech helps over 600,000 Africans make global investments. In 2023, the fintech acquired Chaka, an investment platform in Nigeria similar to itself, and in 2024, it made another acquisition in Kenya by acquiring Hisa, a Kenyan-based investment platform. I’m excited by how Rise has strategically managed to work with other companies through acquisitions of what you could call competitors. Their strategic moves and impressive numbers make me want to keep an eye on them in 2025.

Rise’s 2024 in Numbers

8.Grey

“A remote African workforce can power the world’s digital economy” but how are they going to get paid? Grey helps the African remote workforce secure bank accounts in the UK, EUR, and US without physically being there. The demand for global UK accounts is huge, but distributing the solution isn’t easy. Grey has registered over 1 million freelancers on the platform, and I’m really eager to keep an eye on them in 2025.

9.Miden

It is a global belief that in the future every company will become a fintech. But how can that happen? Companies like Miden are building platforms that allow any company in Africa to embed fintech features and other financial services while providing the necessary infrastructure and ensuring compliance. Backed by Y-Combinator in 2024, they have issued over 100,000 cards and are led by a team of ex-bankers who truly understand technology. I’m definitely keeping my eyes on them in 2025.

Banking-as-a-Service (BaaS) fintechs perform well globally.

10.Mono

A Y-Combinator-backed fintech started with an open banking product and has now evolved to offer even payments powered by its infrastructure. One of their products I admire is OWO, launched in 2024, which helps people make payments on WhatsApp faster. This is one of the reasons I’m keeping a close eye on them in 2025, as I believe anything built on WhatsApp, when executed well, has the potential to scale significantly.

10+1= 11. Swahilies

Based in Tanzania (yes, it’s my company👋!), we launched Swahilies in 2021 as an e-commerce installment platform. Later, at the end of 2022, we pivoted to become an app that helps SMEs record transactions, manage inventory, and build credit scores to access credit and other financial services. Currently operating in Tanzania (though in December 2024, we partnered with SPENN to strategically expand to Zambia), we have over 10,000 SMEs on the platform, 10% of whom are paying users. In November 2024, we opened a $200K round, and this month we are closing it, with $160K already secured.

If you are an investor or know of any investor interested in backing founders like me who have actively worked with SMEs for the past five years and have a long-term vision to digitize African SMEs please introduce them to me Asap.