The annual stablecoin transfer volume reached $27.6 trillion in 2024, surpassing the combined volumes of Visa and Mastercard by 7.7%. What are Stablecoins? Imagine Bitcoin, but its value is always equal to the dollar. Nobody buys or holds it to make money by selling it at a higher price. Stablecoins are digital versions of the dollar that don’t fluctuate in value like other digital currencies do. They are built on blockchain, meaning they are secure and don’t depend on central banks. Stablecoins are easy to access and are available everywhere, especially in places like Africa where traditional dollars are hard to get. They also cost less to send and are processed faster, making payments ~ instant .

Stablecoins seem to have high winning odds in emerging markets

Stablecoins have a global use case(CFOs use stablecoins to manage corporate treasury,) but it seems like they are more likely to create bigger value and impact(and finding product-market fit)

in emerging markets( SpaceX uses Stablecoins to repatriate funds from Starlink sales in Argentina, Nigeria, and other markets) like Africa than in most developed markets because emerging markets often face challenges like limited access to traditional banking and unstable local currencies, making stablecoins a more useful tool for payments, savings, and more financial services.

Stephen Deng is the General Partner ar DFS Lab, a research-driven venture capital firm for Africa that invested in 30+ companies.

What Can Stablecoins Do for Africa?

When a new payment system emerges with qualities similar to the dollar, high distribution, stable value, global acceptability, faster and cheaper transactions, and near-instant settlement; it is expected that more use cases will unfold.

Stone is the founder of Eversend, a remittance startup with stablecoin features for consumers and businesses. Joe Kinvi is the investor and founder of Borderless, an investment platform for the diaspora.

Samora Kariuki is a founder of Frontier Fintech newsletter

While it may be too early to experience all the potential use cases in Africa, starting by allowing African consumers, freelancers, or international employees living in Africa to receive their money faster and cheaper is a big step. There is a lot that stablecoins can offer to African businesses and fintechs, as Nico, COO of Nala, African Payments company, shared what he sees, which I also see.

Backers want stablecoins to work in Emerging markets

There are different stablecoins, such as USDT, USDC, and UCDE, but USDT accounted for 79.7% of stablecoin trading volume on average in 2024. Last week, Tether, the company behind USDT, led a $10 million pre-seed round in Mansa, a stablecoin fintech that allows businesses and payment companies mainly in Africa to settle transactions and fund customer accounts instantly. This signals that the full potential of stablecoins in Africa is yet to be seen.

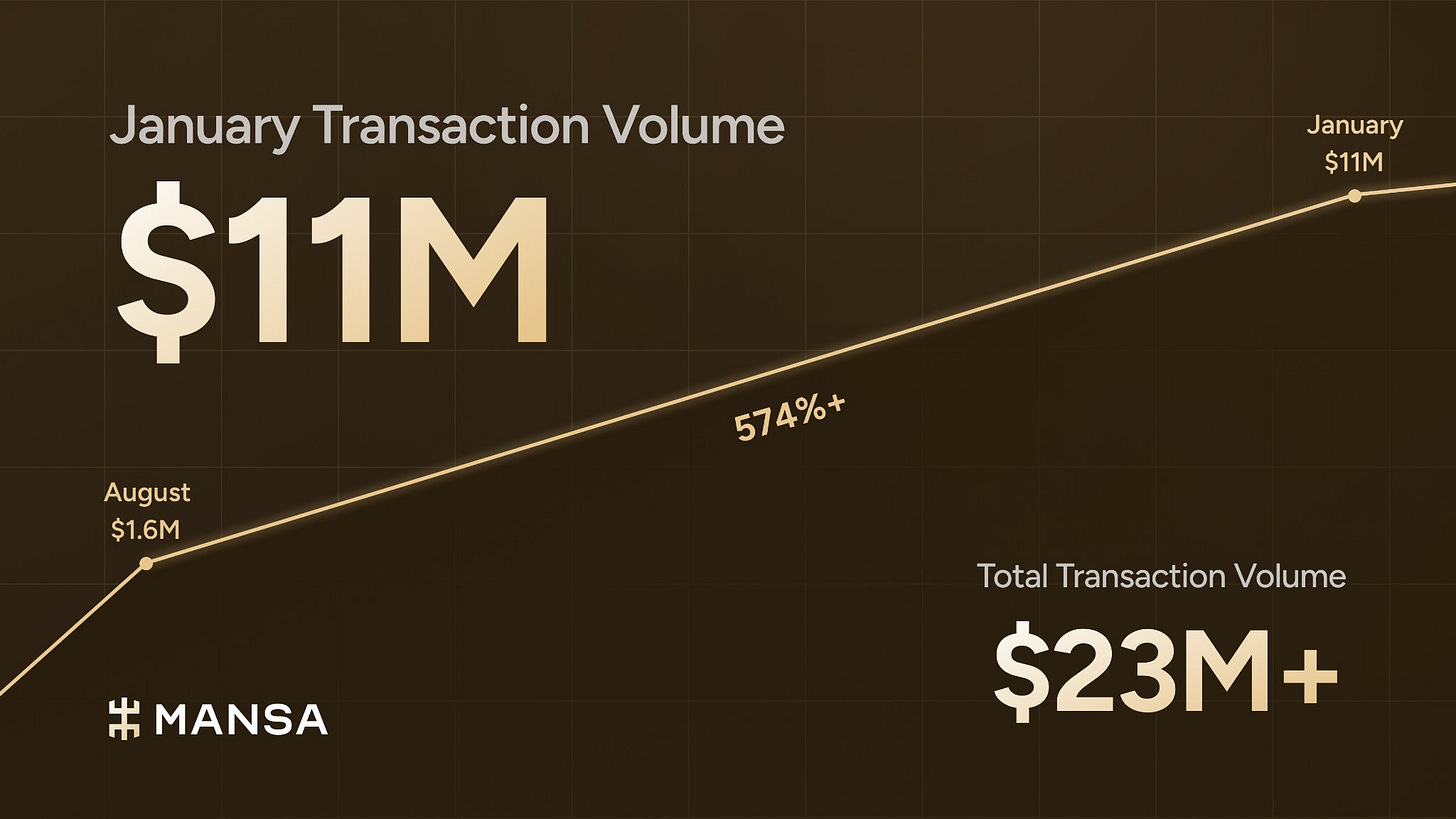

Mansa processed $11 million in on-chain transactions In January 2025

What can challenge stablecoins in emerging markets?

Regulatory Risk; Still, most countries in emerging markets haven’t regulated stablecoins, and some may have banned them. That has always been the case and could somehow challenge adoption, but lately, there seems to be a shift.

Jason is the COO of Yellow Card, one of the biggest crypto and stablecoin fintech companies in Africa.

On-Ramping and Off-Ramping challenges; The promise of stablecoins on low fees, fast settlements, and high accessibility doesn’t speak much on off-ramping (converting stablecoins into local currency) and on-ramping (converting local currency into stablecoins) costs and challenges, where sometimes these costs might be higher or similar to traditional expensive banking fees. But with the launch of new players like Mansa, backed by USDT’s issuer, with the major focus to solve liquidity issues on stablecoins, this might somehow be solved and continue improving, driving adoption.

Benjamin Fernandes is the CEO of Nala, an African payments company. Eche Enziga is the founder of Afropolitan, a community for the African diaspora.

The future of payments in Africa

An insight by Bernard Berlin Beta Parah, Founder at Bitnobi.

And yes, I’m exploring some stablecoin use cases in East Africa

I’m working on a few stablecoin use cases in East Africa. If you are involved with stablecoins in East Africa, let’s chat about off-ramping and on-ramping here in Tanzania and explore potential collaborations; Ping me! Founder@swahilies.com, +255682411725 - WhatsApp.