Nǐ hǎo; My Africa-China Tech-Business Trip Experience

My 6 key experiences from my Africa-China Tech-Business trip

At the end of August 2024, I traveled to China, where about 16% of Africa's imports come from, and stayed for two weeks. My company, Swahilies, helps over 20,000 Tanzanian SMEs manage their businesses (record sales, spending, inventory, and access financial services), and over 50% of the products sold by our SME customers are imported from China. We were curious to learn about the entire business chain between China and Africa, where last year China-Africa trade amounted to a record total of $282 billion. I spent most times between Guangzhou and Shenzen.

Every day in China felt like a semester full of lessons and things to think about: Looking at their large population; 1.4+ billion people (~big market size), their physical infrastructure (~long-term committed investment; those better roads and other infrastructure didn’t just happen), their digital transformation (I never used cash at all for two weeks, and it wasn’t a task or challenge - it was a lifestyle), and their discipline and organization (it's not easy to manage such a large population so effectively; I heard some people say Rwanda is well managed and organized because it is a small country, which I disagree with even more after visiting China, a much larger country where most things are in place, proving that everything is possible no matter the size).

During these moments in China, I found myself thinking a lot about my country, Tanzania. Now that I'm back in Tanzania, I wanted to share few things i experienced from this trip.

1.Digital Payments: Adoption Now, Profit Later;

In Tanzania, whenever someone wants to make a C2B(Consumer to Business) payment digitally, the first thing they think about is the fees. They then decide if it's worth it or if they should just use cash. Of course, most opt for cash (over 90% of payments in Tanzania are made in cash) because it’s unreasonable that a consumer may want to pay 5,000 TZS to a vendor, but the transaction fees charged to make this payment are 1,000 TZS (20% of the transaction), that 1,000 TZS (20%) could help an average Tanzanian buy something else, like airtime, electricity tokens, breakfast and more.

This is very different in China, where even I, as a tech-savvy person, at first I had to sit down and ask, 'So, where does Alipay make money?' Most payments had zero transaction fees, which is why every vendor or person I spoke to was confident in accepting digital payments. You can see that companies like Alipay, which have been around for 20 years, have most customers on their platforms and still believe fees shouldn’t feel like fees.

This approach is very different from that of most African payment providers, like mobile money companies, who have not yet captured the majority of the market (because most people still use cash). Instead of focusing on adoption, they deal with the few active customers they have onboarded, charging them high fees without considering how this widens the gap and encourages people to keep using cash. They are comfortable making most of their money (through high fees) from the few active customers they have, instead of acquiring more customers and making a small amount from each, which would make them more money and give them more customers in the long term.

2.Logistics infrastructure as a key ecommerce enabler;

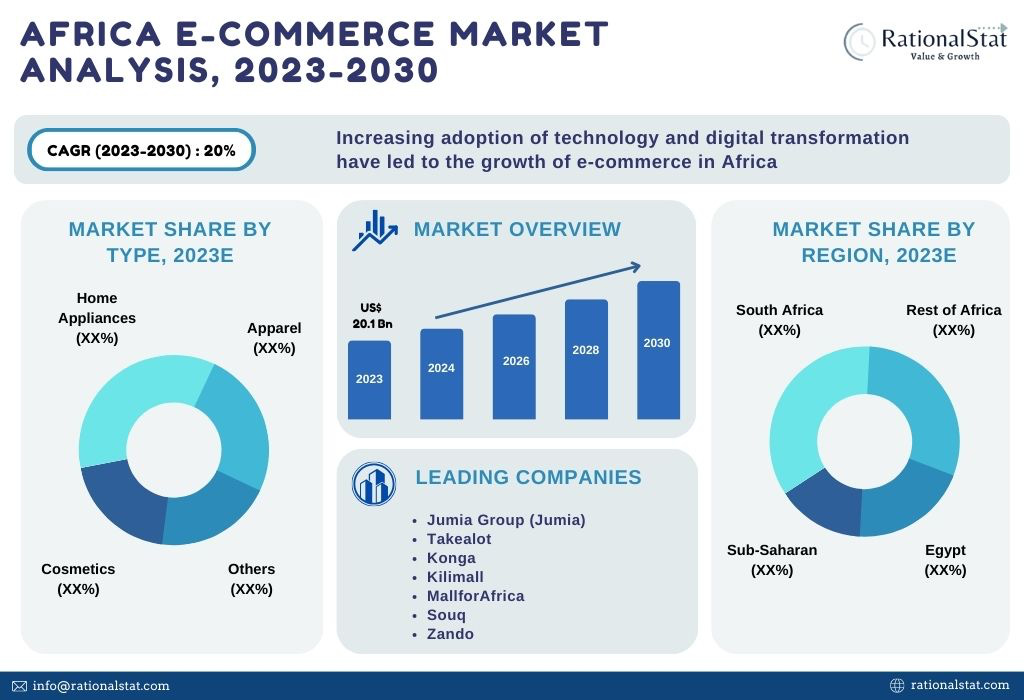

One of the industries that has been struggling in Africa is e-commerce. Despite companies like Jumia raising nearly a billion dollars in funding, it has been a nightmare due to many factors including logistics challenges such as poor roads, traffic, and other challenges, which result in thin margins (and sometimes losses, with all margins wiped out, especially when selling low-ticket items). This is why even companies like Jumia are now focusing on high-ticket products.

When an African consumer wants to buy something from a vendor they have met online, after trust issues, the next major point of negotiation is delivery: who should bear the cost, how much it should be, how long it will take to deliver the product, how secured the product will be during delivery and so on.

You can invest a lot of money in a great e-commerce app or website with good digital payment solutions (thanks to platforms like Flutterwave, Paystack, Selcom, Cellulant, and others that have made it easier to make and accept payments on e-commerce platforms in Africa). However, if the delivery logistics are broken, it will be difficult to build and scale a successful e-commerce business. The challenge is that you can't simply code a great delivery infrastructure; it must first be built physically and then maybe made programmable later for better insights.

China has built an excellent, programmable delivery logistics infrastructure, that is why you can chat with a vendor and never have to worry about logistics. E-commerce platforms there may face other problems, but delivery is not a major issue. China has great, simple, and cheap payment platforms + great programmable delivery logistics, which help their e-commerce sector continue to thrive. As we in Africa remain optimistic about transforming our continent digitally, we must also pay careful attention to non-digital aspects like logistics infrastructure and find ways to align with it. It is easy to focus on all things online and ignore key offline infrastructure, which could later challenge all our efforts.

3.Social Commerce works in China and can work in Africa

Majority of Tanzanians will not buy something online without speaking or chatting to a vendor first, even if all the product's details are provided. Someone will still need to initiate a conversation first. This might be due to cultural factors, such as low trust issues. In developed markets like the US, the selling cycle in e-commerce can be short: you list products, a customer finds it, confirms, and makes the payment without ever chatting with the vendor. However, in Africa, the process is different.

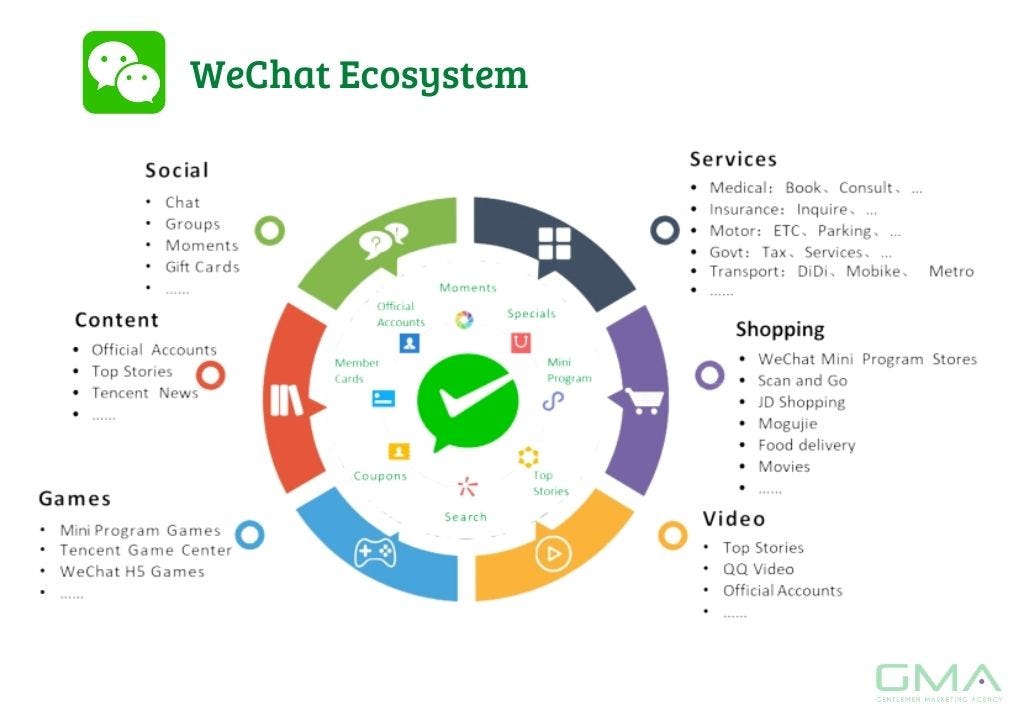

I noticed a similar pattern in China where most transactions are conversations first, even if you go physically to a shop and do window shopping, vendors will often ask you to scan their WeChat QR code so they can stay in touch and try to convince you to buy later at a better price or with more benefits. This is also happening in Tanzania, where people buy products from Instagram and Facebook vendors, chat, negotiate, and close deals. The only issue in Tanzania is that payments can not be completed on these social media platforms, so customers always need to use another platform for payment.

In China, it’s convenient because you can chat with a vendor on WeChat, negotiate, and make payments without leaving the Super app.But i recently read about ChitChat, an African social e-commerce platform that connects consumers and businesses to chat, explore products, and process payments on the same platform. The rise of such platforms makes me believe that we might soon be on the right track to build our own version of WeChat for Africa that is locally relevant to our continent. It is either we are going to have locally built social commerce platforms or the existing social media platforms like Instagram, Facebook and Whatsapp will integrate local African payment channels on their platforms. I believe the future of African e-commerce lies in social commerce rather than traditional commerce models.

4.Sending money to China from Africa is more of who you know

Since 16% of Africa's imports come from China, i just thought that billions of dollars are moving from Africa to China so why i don’t see more African Fintechs powering money movement between Africa and China?. I engaged with different African SMEs while I was there to understand how they send money to China and how they obtain Chinese currency to pay suppliers. In Africa, I have seen few options for sending money to China, such as Kenya-based WapiPay. From discussions with SMEs, I learned that many obtain Chinese currency from their friends in China who sell it at competitive rates compared to banks. The process involves an SME sending money to a Tanzanian account of someone holding Yuan in China, who then credits them on Alipay so that they can proceed with paying suppliers using Alipay

For some transactions involving some millions of dollars, SMEs use a similar method but rely on their network of large Tanzanian and Chinese traders who exchange money at better rates, however there should be other transactions that happening via banks but not of most SMEs. Moving money between China and Africa presents a big opportunity, but it is a market that requires a deep understanding of compliance and existing practices. Some opportunities remain untapped for specific reasons, so more research is needed to grasp this market.

5.Chinese people mean business

Every time I visited a fashion or electronics shop, a vendor would quickly take out a calculator, and the next question after “Nǐ hǎo” (Hi) would be “many many?” to confirm if you were buying many pieces. China is known for having cheaper prices, but the reality is that the minimum order quantity (MOQ) dictates the price. Someone buying 100 pieces will not have better wholesale price and margin than someone buying 10,000 pieces. For some products, buying just one piece might not be much cheaper than buying it in Africa.

Chinese vendors are quick, sharp, creative and better on negotiations. They also don’t get bored with customers who might ask details of about 100 different products and never make a purchase. They prefer to keep in touch via WeChat, believing there will be future opportunities. While many African vendors might view this as a disturbance to engage with a customer who asks about 100 products and buy none, the Chinese see it as part of the process, as most transactions are conversations first. This approach is why social commerce is thriving in China because vendors are so confident and positive that even if you don’t make a purchase today, there is a room to connect, build relationship and see what you can purchase next time.

6.The language barrier is a problem, but Chinese people don’t see it as an excuse, and technology is helping to fight it

One thing that really surprised me was that most Chinese people don’t speak English. Only 1% of Chinese speak English but 300 million Chinese are learning English. For face-to-face communication, you mostly need a translator to keep the conversation going. However, once you get their WeChat and start chatting there, it becomes easier because auto-translation is activated. This allows you to communicate more effectively and progress to the final stages of doing business with them. They don’t speak English but you can feel how they are making efforts to close the deals even when the language seem to be an issue.

The question on my mind

With all that I have seen and experienced in China, especially observing their ability to produce almost everything they use daily and for export, the question on my mind is whether we, Africans, can truly transform our continent without focusing on how we can start producing more for ourselves. Do we have long-term plans and strategies that could eventually make us a less importing continent?

Thanks for reading! You can personally contact me via Twitter or LinkedIn or Email me at founder@swahilies.com for any feedbacks.

This was an excellent read. Sounds like a very worthwhile trip. Some great points, especially regarding building relationships first and doing business later if a sale can't be made right away.