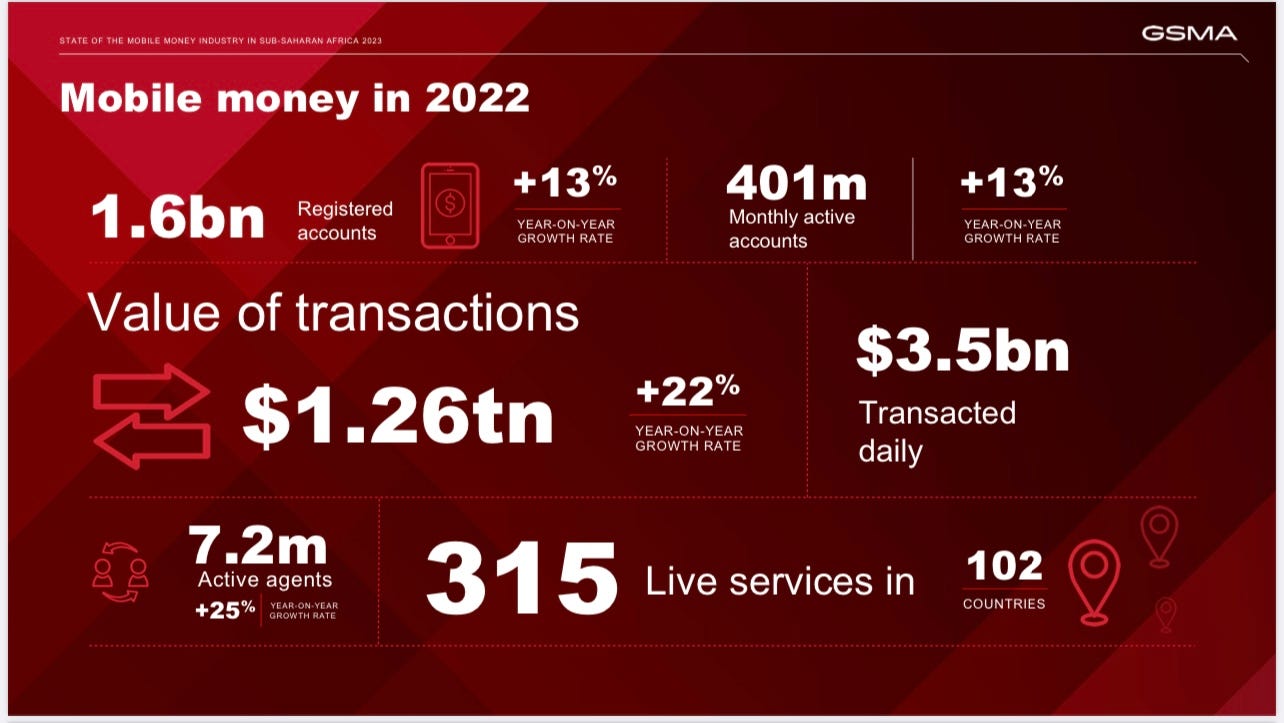

It is hard to talk about African financial services without mentioning Mobile Money. I read a tweet that said, “someone dies if M-Pesa goes down for 20 minutes in Kenya.” Sub-Saharan Africa has 1.6 billion registered mobile money accounts that transact $1.26 trillion per year.

State of Mobile Money in Sub-Saharan Africa 2023

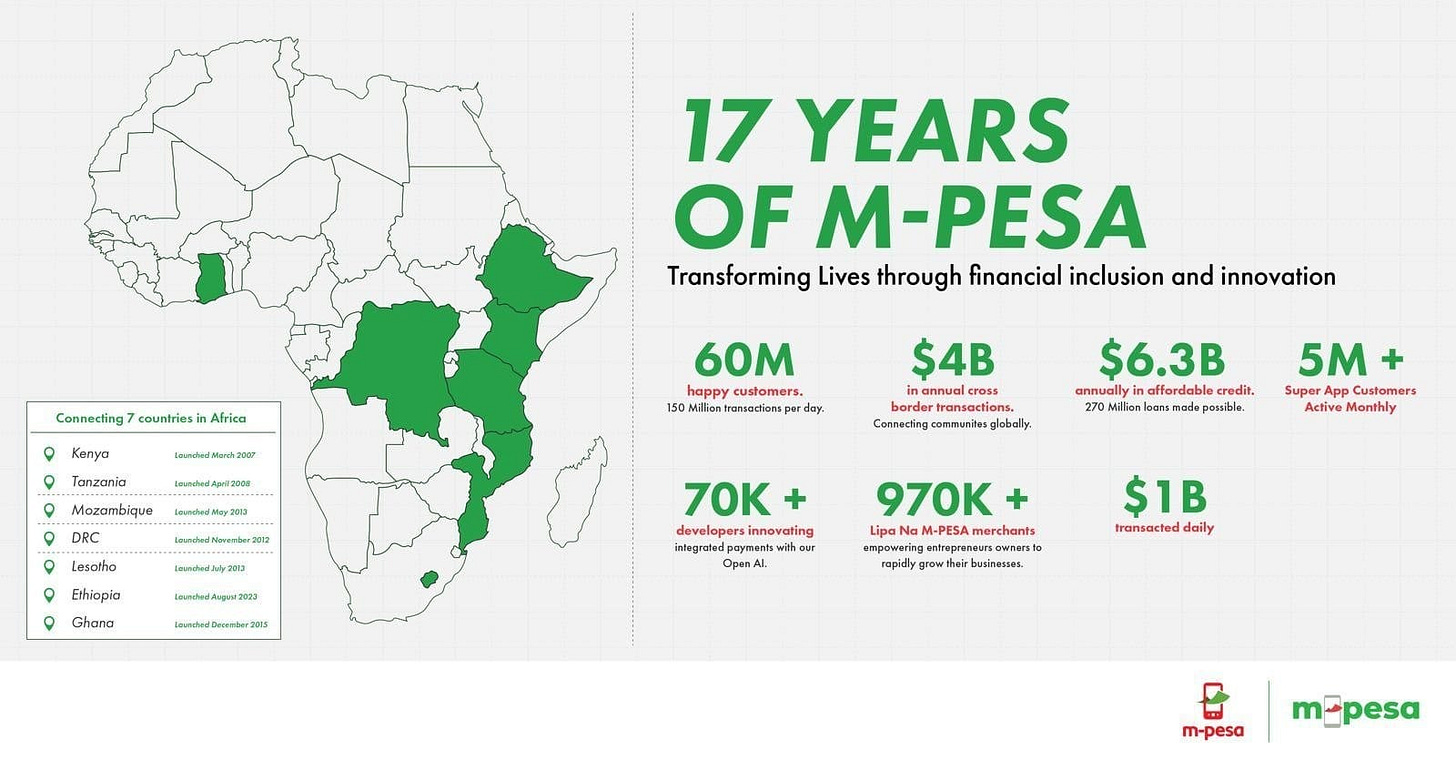

Of the $3.5 billion daily mobile money transactions in Sub-Saharan Africa, M-Pesa claims to be transacting $1 billion per day.

M-Pesa by number

Most mobile money services like M-Pesa started to power local payments from peer-to-peer, to cash in and out via mobile money agents who are now 7.2 million in Africa. These agents are seven times more accessible than ATMs and ten times more than bank branches.

Mobile Money For Global Payments

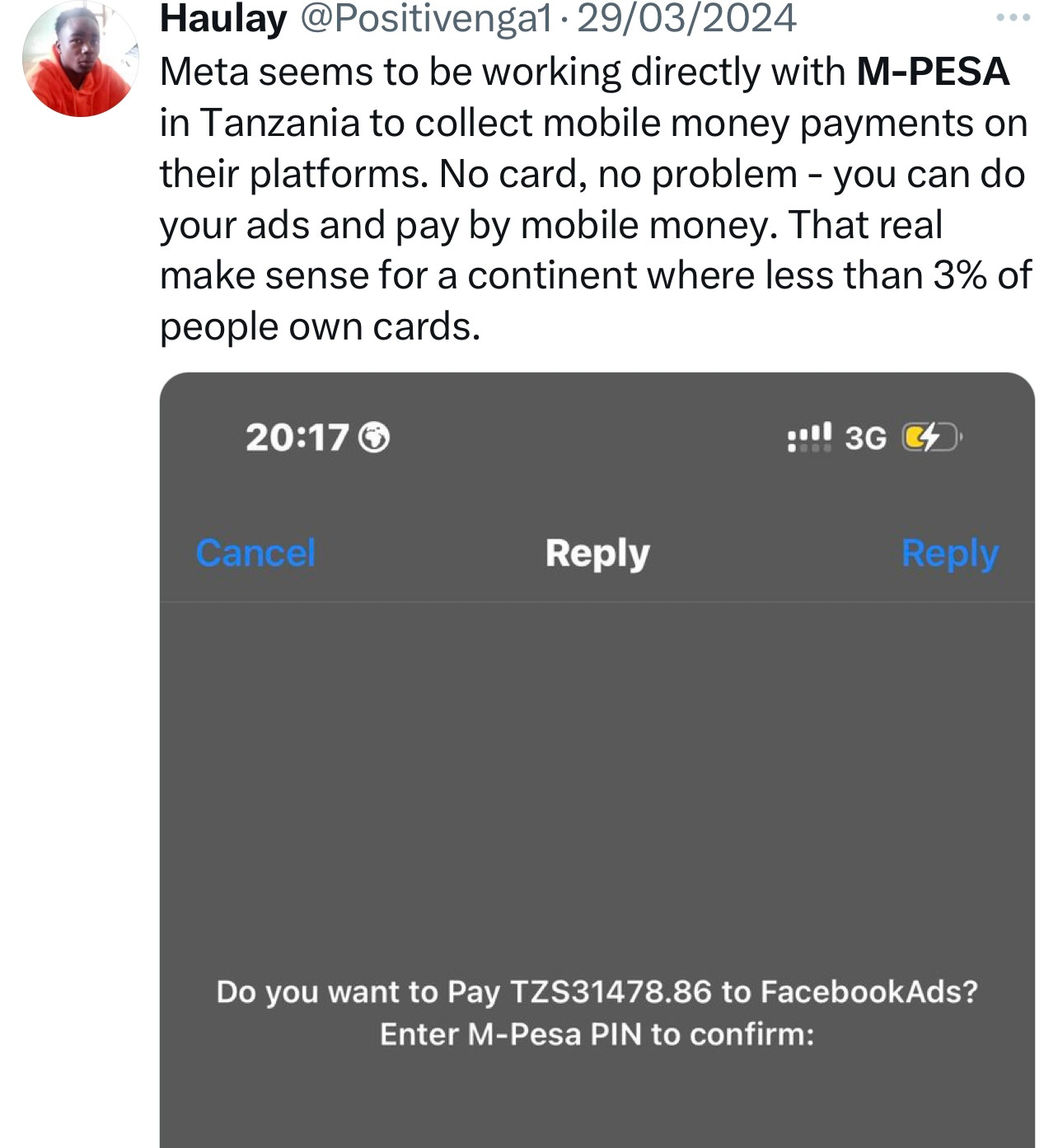

After improving local payments, a new opportunity arose a few years ago to connect and let mobile money users pay on global platforms like Alibaba (because Africans buy many Chinese products), Facebook (Africans now use social media to do business and need to pay for sponsored ads), and more. As an over-import continent, people will always need to pay abroad to import goods.

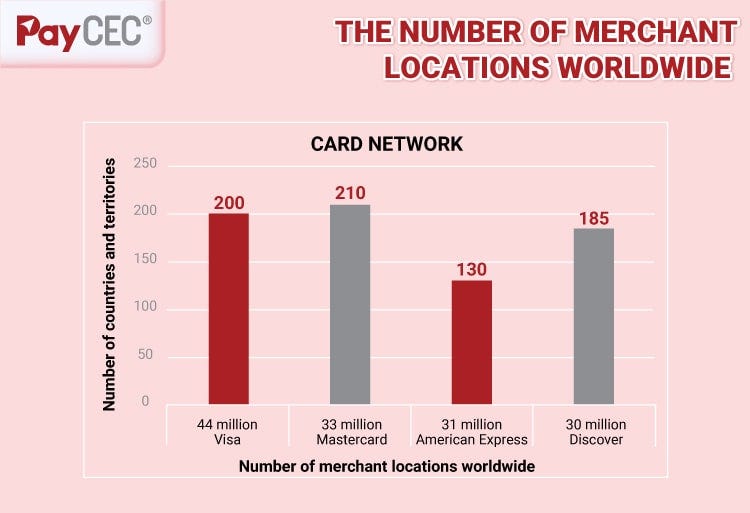

Because mobile money was initially built for local payments, there was a need to partner with international partners to make this possible. This led to the creation of mobile money virtual cards powered by partners like Visa and Mastercard, which have millions of international merchants.

The number of merchants by International merchant network owners like Visa and Mastercard.

These virtual cards are built into mobile money, and users can follow a few steps to activate them within their mobile money accounts and start using them. No new KYC, no third-party app or platform! just within the same mobile money platform where customers are already in.

But why would someone create a mobile money virtual card instead of using a card from a bank? Fewer people use banks (for instance, in Tanzania, about 22% use banks, while over 70% use mobile money, and card penetration is even lower; only 3% of Africans own credit cards - the lowest credit card penetration rate of any region worldwide). For many consumers, their mobile money virtual card is the first card they have ever created and used to make payment.

Mobile Money for Global Payments: What is the Trend?

Mobile Money companies are partnering with global merchant network owners (like Visa and Mastercard) to let their customers pay international merchants through Mobile Money virtual cards.

M-Pesa Globalpay Virtual Visa Card

Although this has been working well, there are two main feedbacks. Firstly, some international platforms reject these mobile money virtual cards. Secondly, they can be expensive due to high exchange rates compared to those from banks, as mobile money companies seem to add a fixed margin on top of the exchange rate.

Mobile Money companies are working with global platform owners, allowing their customers to pay directly on the platforms without creating or using channels like virtual cards. Example, In Tanzania, M-Pesa users can pay on Facebook for ads directly without creating cards.

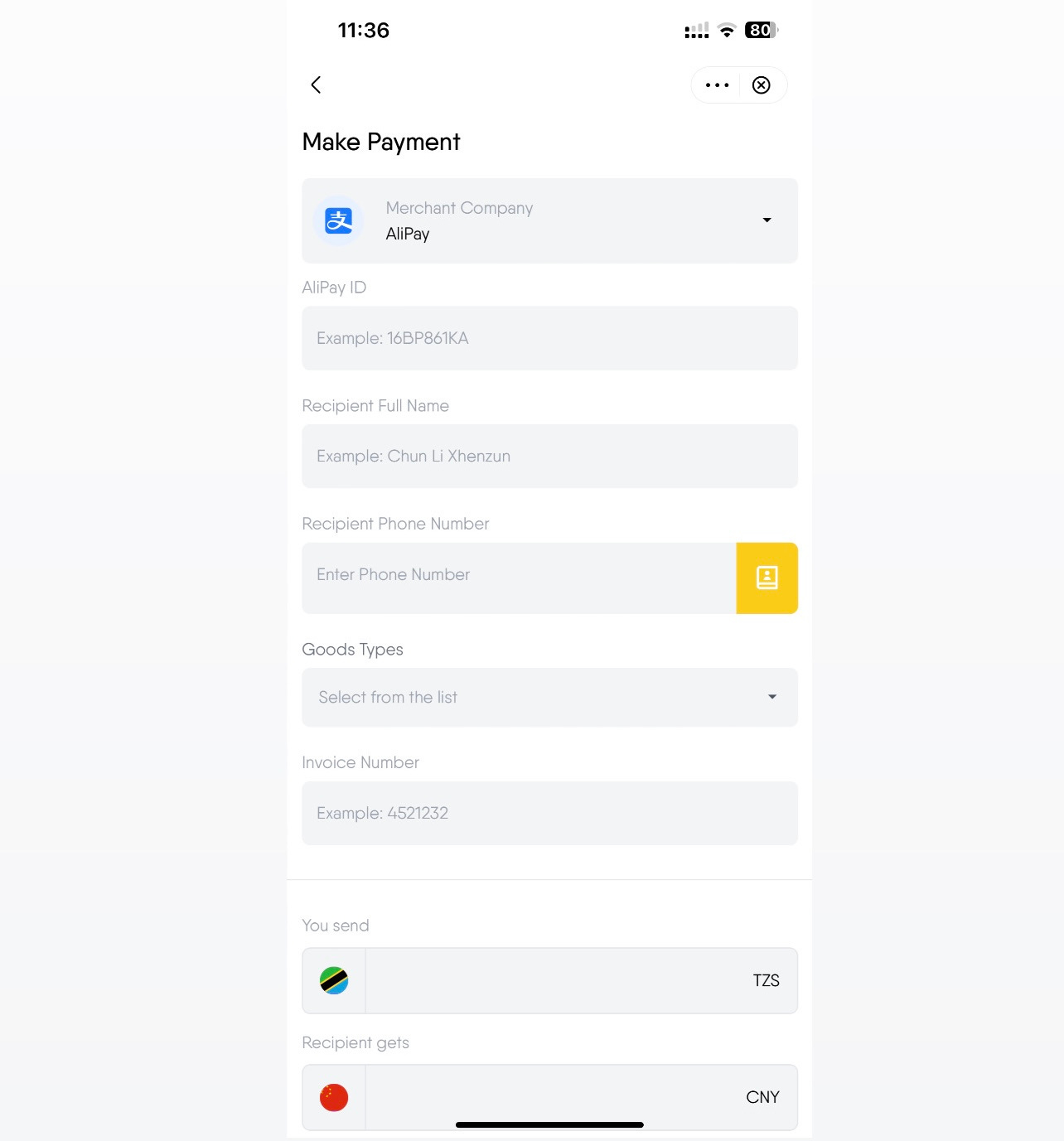

And just this week, M-Pesa announced a partnership with Alipay, enabling their customers to pay Alipay merchants direct from M-Pesa super app.

The few feedbacks I have received is that the exchange rate still seems to be high, and the payments are invoice-based, a process or user experience that is not common for most Tanzanians. There is also a limit issue per transaction; some users reported that most transactions are currently limited to less than $100. I attempted to confirm this with the app, but it kept crashing. With these limits, M-Pesa might be targeting only consumers for small purchases or payments. However, the top transacting users from Tanzania/Africa to China are SMEs, whose transaction limits should be higher than that.

With all ongoing moves, which often don't start perfectly, it is fair to say that Mobile Money is open for international business! Are you? Let me know your thoughts, and I will share them in the next article.

Thanks for reading! You can personally contact me via Twitter or LinkedIn or Email me at founder@swahilies.com for any feedbacks.