Africa's insurance market is $68 billion in Gross Written Premiums. Over 70% of this business is based in South Africa, with an insurance penetration of 17%. Kenya has an insurance penetration of 2.7%, while Tanzania has a penetration of 0.7%.

In Tanzania, Mobile money companies are now heavily investing in insurance products. Vodacom is massively pushing its VodaBima/Insurance product to its customers via M-PESA where in two years, VodaBima sold over 1.5 Million policies to over 200,000 customers across its portfolio of services i.e Motor, Health and Life insurance.

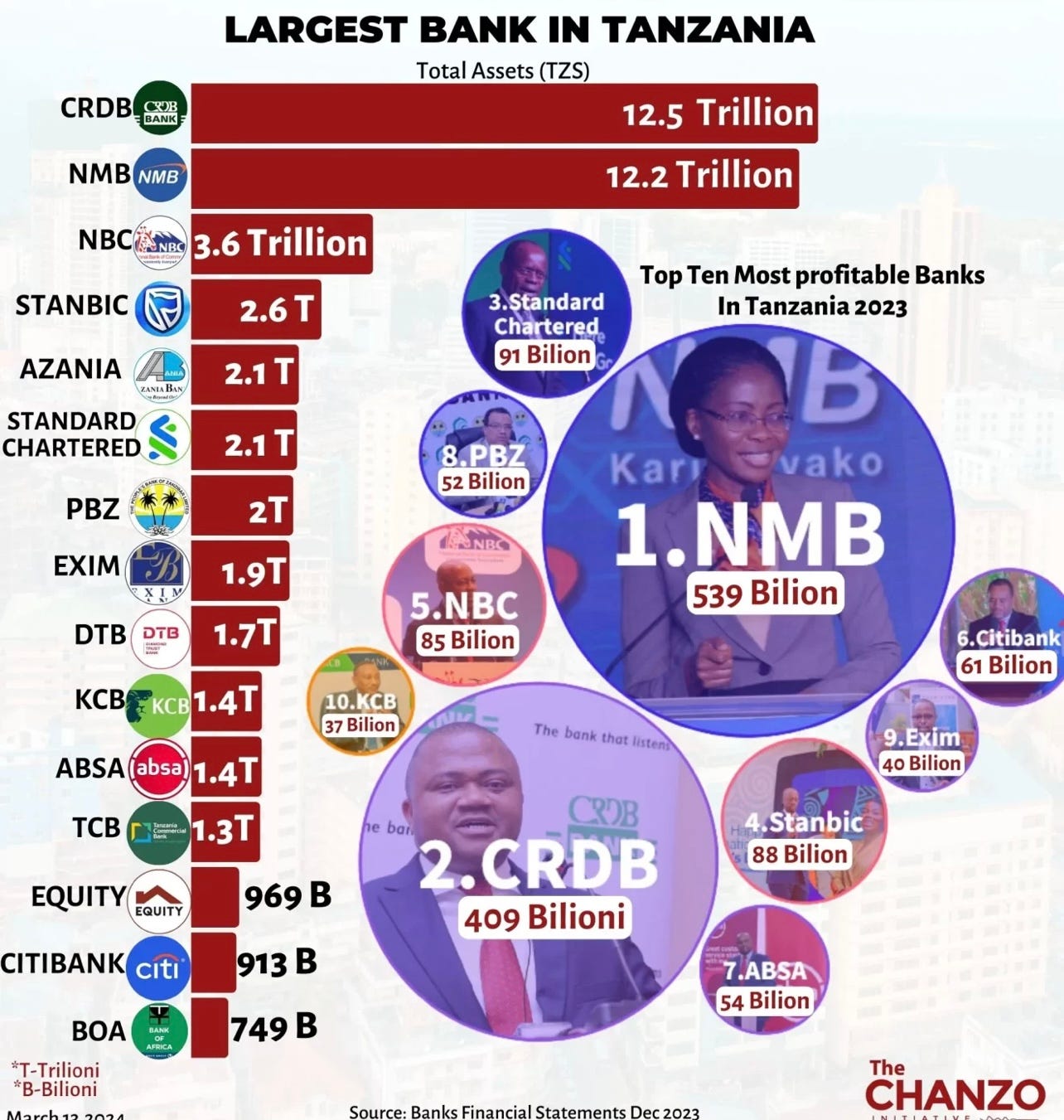

Banks aren't behind on this; yesterday, the largest bank in Tanzania by assets launched a standalone insurance company, CRDB insurance.

Largest banks in Tanzania

How to insure Africans

1.Education; The first and most important thing to focus on in insurance is education. Many Africans have low education and awareness about insurance. At some point, Benjamin Fernandes, Founder of Nala, mentioned that in Africa, an insurance company's major competitor is Jesus, not other insurance companies. Many people believe strongly in prayer as an alternative to insurance. This indicates that more education is necessary.

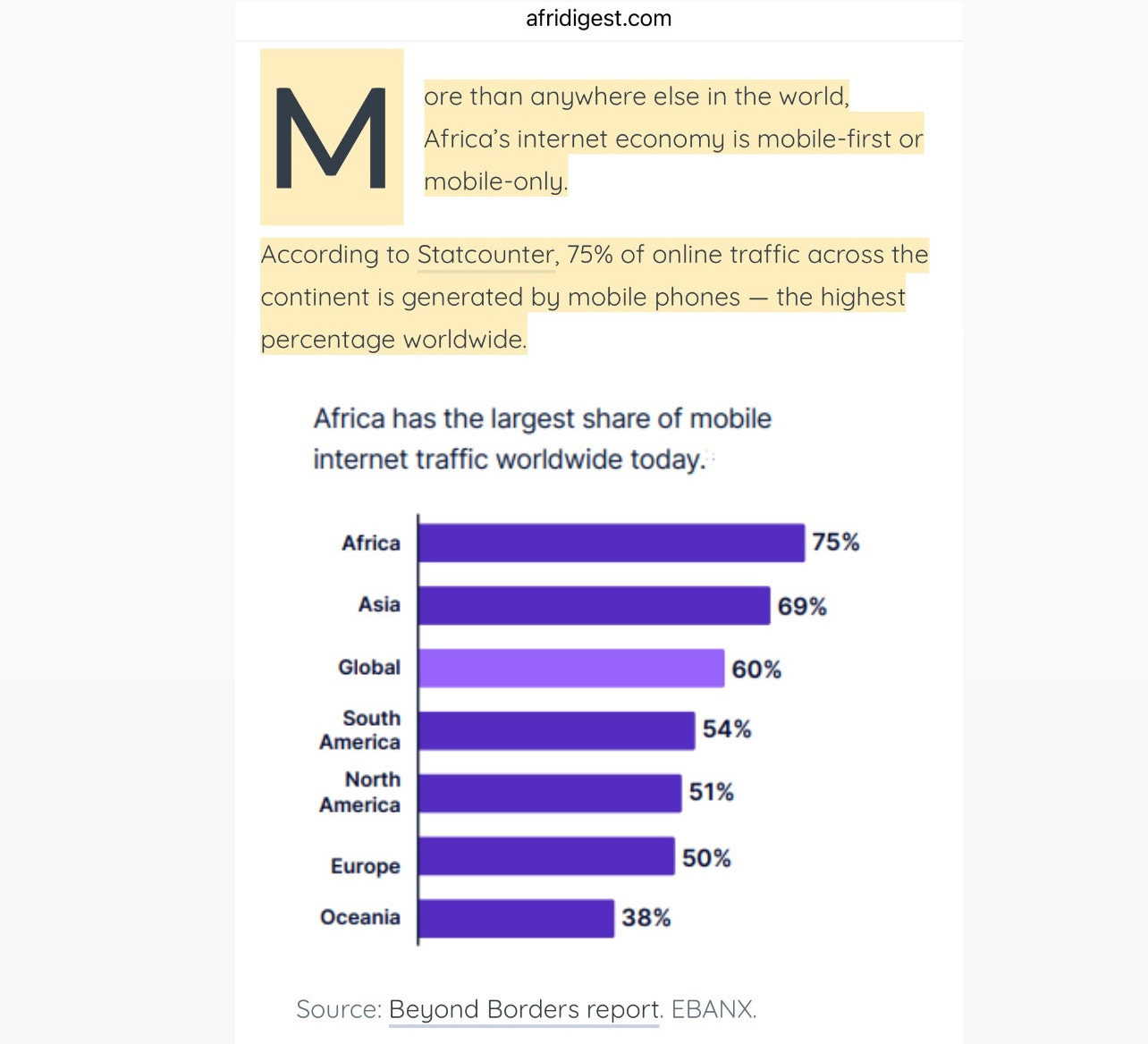

2.Identify a large audience (the bigger the pool, the better the insurance business), their frequent activities, and distribution platforms (USSD, WhatsApp, Mobile App and more). Always remember that Africa is a mobile-first continent and so your distribution strategy should prioritize that.

3.Calculate the most affordable price they might pay without really feeling the cost.

4.Create the cover and Embed into their frequent activities by sharing some costs with partners in the transaction.

For example, Selcom Tanzania (payment provider), Bimatime (insurance provider), and Puma have partnered to offer a 7-day life insurance cover to anyone paying for petrol at Puma using Selcom. They have issued over 1,000,000 insurance policies so far. A win win to all partners.

Instead of potentially asking consumers to pay around few hundreds TZS for 7 days of coverage, these companies have utilized their economic resources to cover the cost for the consumer in a manner that drives their business strategically and financially. Car fuel is one of the most repetitive expenses for car owners, so adding insurance on top of it makes much sense and also drive retention for the business.

Currently, I'm in touch with a logistics company that is working to purchase insurance for their SME customers who use the logistics services at least 5 times a month. The insurance partner in the chain also wants these SMEs to become insurance resellers by embedding insurance when consumers purchase products. There is a lot starting to happen in the insurance sector, as I see it.

A similar model can be applied by embedding insurance when people buy or pay for their other frequent necessities. It has to be affordable and offer value to both partners in the transaction, such as boosting customer acquisition or retention, to encourage cost sharing that makes insurance affordable for the consumer.

It is hard to convince most African consumers to maybe pay upfront 4,000 TZS ($1.53) for insurance per month, but that is 133 TZS per day. The easiest way to convince them is to break down these costs, share them with other partners, and perhaps let consumers pay the cheapest amount while encouraging them to unlock additional coverage days as they keep buying or consuming a certain service.

Traditionally, it was impossible to sell insurance at 133 TZS($0.051) per day by cash, but today, with technology, it has become possible to do that in different ways, including debiting daily after embedding it into someone's daily digital transactions when they pay for or purchase products or services.

Insurance in Africa means more partnerships to lower the cost. People have tighter budgets to pay upfront for insurance. Partnerships make it easy to lower the cost and to collaborate on driving adoption and boost retention.

I think a lot is happening at the moment to make insurance work for Africa, and I'm just bullish on that.

Thanks for reading! You can personally contact me via Twitter or LinkedIn or Email me at founder@swahilies.com for any feedbacks.